🔑Key takeaways:

- Edge computing is about local (near data source) data processing and storage.

- Cloud computing is about cloud-based data processing and storage.

- Edge computing and cloud computing can complement one another.

- Edge computing can reduce network congestion by limiting the amount of data that needs to be transmitted to the cloud.

It’s no secret that edge networks, edge computing, and IoT are some of the biggest current trends in IT circles. In fact, Gartner projects that 75% of data will be created and processed outside of traditional centralized locations by 2025, up from about 10% in 2018.

Networks that power financial services are fast becoming one of the most exciting areas for edge networking. Financial services organizations can use IoT, artificial intelligence and machine learning, and automated network management to improve end-user experiences, optimize network performance, and drive innovation across a variety of applications. That said, admins can’t snap their fingers and go from a legacy of centralized networks to edge networks in a heartbeat (wouldn’t that be awesome?), and there are real challenges involved in making the transition.

Let’s take a closer look at edge networks in the banking, financial services, and insurance (BFSI) industry, and what all the hype means from an IT manager’s perspective.

Legacy technology and tech debt in financial IT

Legacy technology is a common reality in financial IT. Machines running out-of-support operating systems, old proprietary software programs, and decades-old COBOL mainframes are all too often part of day-to-day operations in the space.

In fact, many systems used in the financial industry haven’t been updated since the 90s. As you might expect, this leads to quite a bit of tech debt in financial IT. Maintaining legacy hardware and software doesn’t come easy, and painful tradeoffs are often made.

“Deployment at the edge” is changing financial networks

The modernization of legacy banking systems has been a big trend for years. According to a WSJ CIO Journal article earlier this year, modernizing networks using technologies like Web3 and software-defined networks (SD-WANs) were among the key priorities. One of the most interesting use cases identified was Mastercard’s plans to enable faster payments with edge computing. The idea is simple: payment authorization decisions that used to be made at a centralized location will instead be made by the payment device, like a smartphone.

This is a great example of the power of deployment at the edge for the complex world of finance and IT: moving storage and computing resources as close as practical to data sources. We’re shifting from a centralized model—where most processing and storage occurred in the cloud or at a corporate data center—to a more decentralized model. By moving the processing and storage closer to data sources, edge networking can speed up transactions, improve security, and enable workflows that weren’t possible before.

But this begs the question: what makes edge networks possible now that wasn’t available before? Frankly, it isn’t just one thing. It’s several technologies maturing to the point they’re now viable for production use.

Specifically, advances in AI, cloud computing, and IoT, coupled with high-throughput wireless technologies like 5G, help enable edge networking. Banks and other financial institutions now have the bandwidth, data, and processing horsepower to make decisions at the edge, and the agility to support the dynamic nature of edge networks.

What’s the difference: Cloud computing vs edge computing?

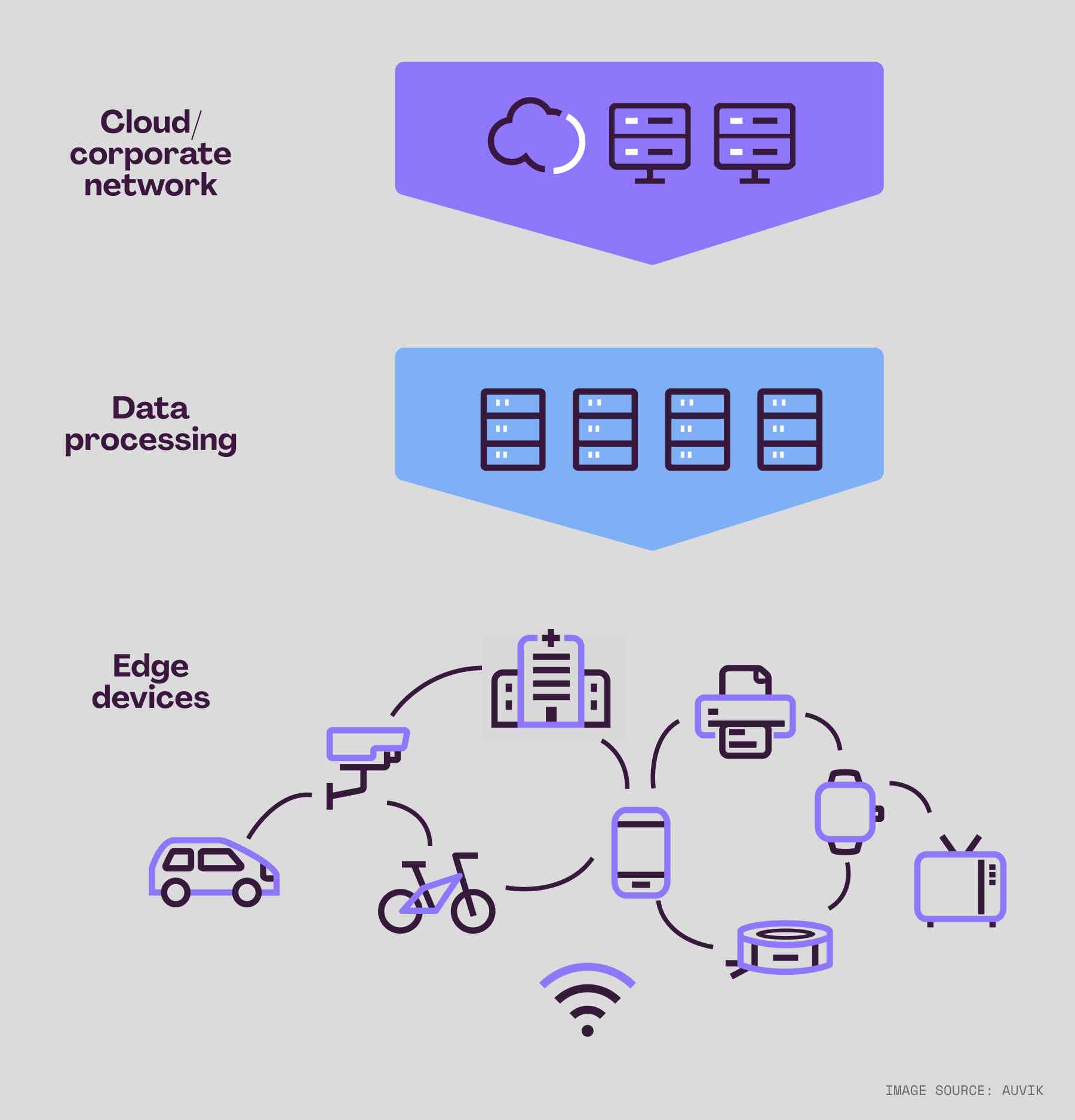

Fundamentally, decisions on where to process and store data are what drive whether or not a given application can be described as “edge computing.” If the data is processed at or very close to where it is generated (e.g., on a smart device), that’s edge computing.

The alternative to edge computing is sending the data to some other off-site location for storage and processing. In addition to enterprise data centers, “the cloud” is a popular off-site destination for data because its destination is, unlike a single data center, just about everywhere you need it to be. Cloud providers make it easy to support data ingestion and processing at scale, and enterprises take advantage of that.

While they are two different approaches to data processing, they complement one another quite well. Edge computing is ideal for use cases where a lot of data needs to be processed. It will also help reduce network congestion and bandwidth utilization because data no longer needs to be sent to a central location for processing. Cloud computing, on the other hand, is better suited for data aggregation and use cases where the edge doesn’t have enough compute or storage capacity.

How can an edge network help my financial IT network?

Admittedly, this has been a bit buzzwordy and high-level to this point. So, let’s move on to the cool stuff, some of the practical use cases for edge computing and edge networks in the financial space.

- New and faster payment options. Intelligence at the edge can enable payment options based on facial recognition, retina scans, and other biometrics. Smile to Pay from Alibaba’s Ant Financial is one example of the possibilities. And for consumers that prefer not to leverage biometrics or facial recognition (there are certainly privacy concerns the industry must consider), edge payments can still speed up transaction times and reduce payment friction.

- Increased personalization. Apps can improve how they respond to end-users. Technologies like natural language processing (NLP) and computer vision can help personalize responses based on near real-time context. Additionally, in the broader industry, providers can customize the cost of financial products, like insurance, using real-world data collected from IoT sensors (whether you want to do that is another story).

- Enhanced security. Coupling AI and ML with the wealth of real-time data available at the edge can improve fraud detection and reduce the probability an illegitimate transaction is approved.

- Integrations between different apps and services. Point-of-sale (POS) integrations are the obvious use case. Smart home appliances that integrate with banks and vehicles that can automatically pay tolls are other viable use cases that we already have in some form. However, these are just the tip of the iceberg. Trends like Open Banking creates opportunities for a wide range of integrations with third parties.

- More network resilience. It’s no secret that banking outages are costly, but a shift towards decentralization can improve the availability and resilience of financial networks. If transactions are authorized at the device level, an “outage” only impacts that device. Similarly, the impact of a micro data center (MDC) outage is much smaller than a regional outage. Additionally, software-defined networks (SDNs) can greatly improve failover, auto-healing, and fault detection workflows. This isn’t to say edge networking will be a magic bullet that eliminates large-scale outages, but it can help improve overall network resilience.

The end-user benefits of an edge network and edge computing

For end-users, the transition to edge computing and edge networks can improve the overall experience. Some of the benefits are straightforward. Frictionless payments mean faster transaction times. More intelligent security mechanisms mean less fraud and identity theft.

But, there is more to it than that. Edge networks can also change how consumers make decisions, and increase the value they derive from financial services. VR workflows enabled by edge networking can streamline the process of making major purchases (think virtual home tours). More personalization can also lead to better pricing and rates on financial and insurance products.

There are benefits for “corporate” end-users as well. Edge computing is all about improving the quality and speed of insights we draw from data, and there are plenty of enterprise benefits as a result. Algorithmic trading, risk management, and sales organizations can all benefit from intelligence at the edge.

The challenges of edge networks for IT

Monitoring and managing networks that use decentralized or distributed networking creates a different set of challenges and cost/benefit tradeoffs than traditional centralized models. Not only is there “more” of everything (more devices, more data, more connections, more applications, more vendors, more locations, etc.), networks are inherently more dynamic and mobile.

It often takes a lot of upfront work to reap the benefits of network modernization. Generally, with a shift to an edge network, we’d expect more software-defined networking and more automation. And in the long run, that can be true. However, making the transition in practice can be expensive and time-consuming.

Some of the key challenges edge networks can create for IT include:

- Creating a network modernization plan. Many network modernization efforts are often constrained by existing business requirements and workflows. In the financial industry, that can mean IT must juggle supporting legacy apps—and all the tech debt that comes with them—while also planning to replace them with modern tech. And there’s usually no one-size-fits-all answer for getting it right. That makes developing a plan for network modernization one of the most important aspects of a project.

- Security, compliance, and data privacy. There are a lot of exciting and innovative use cases for AI, ML, and data analytics with edge networks and IoT devices. Many use cases involve personal and financial data subject to strict security, compliance, and data privacy policies. IT is responsible for ensuring that data is transmitted and stored securely, and decentralizing where that happens can add complexity to the process.

- Device discovery. Edge networks are full of IoT devices that aggregate and process data. Additionally, centralized data centers are often replaced with cloud services or smaller micro data centers. To enable effective network monitoring, IT needs to be able to discover all these devices across a wide variety of physical locations. This is a fundamental shift from the traditional hub-and-spoke style of legacy centralized networks.

- Documentation. With edge networks and IoT, tech debt can rack up fast. Edge networks change fast and, as a result, point-in-time network documentation goes stale fast. If IT isn’t disciplined about network documentation, network visibility can suffer.

How Auvik provides visibility and monitoring for your edge network

Effective monitoring for edge networks at scale requires the right approach to distributed site management. Auvik is a network management platform that helps IT achieve full network visibility across sites, vendors, and monitoring protocols fast. With Auvik, IT teams responsible for edge networks can:

- Automate their network documentation and discovery

- Use dynamic network maps for real-time network navigation

- Automatically backup network configurations

- Gain visibility across multiple sites with support for 15,000+ devices from 700+ vendors

- Leverage flow protocols and TrafficInsights for granular network traffic analysis

- Put privacy and security first with security features like 2FA, role-based access control (RBAC), and audit logging

- Total Economic Impact study by Forrester found can deliver $567K in improved efficiencies over three years

If you’d like to try Auvik for yourself, sign up for a free 14-day trial today.