The financial sector is in a constant state of change, and institutions must continually adjust to the evolving needs of their customers and the global marketplace. And with availability requirements like the ones European Banking Authority (EBA) provide—99.5%—financial institutions are driven to remain on the bleeding edge of responsiveness and convenience. Banking outages lead to lost consumer confidence and damaged reputations in a sector where trust is the cornerstone of doing business. That means their networks have to perform at their peak, all the time, while ensuring seamless, accurate, and secure connectivity.

Let’s take a closer look at the relationship between financial services and networking, explore the uptime challenges facing financial institutions, and explain how effective IT solutions for the financial industry can limit downtime and have a positive impact on the bottom line.

What do we mean by “financial services & networking?”

We’re talking about the networks banks and financial institutions use for their IT infrastructure, not credit card, money transfer, or ACH networks per se.

All those networks interconnect different institutions and are an important part of any financial systems’ connectivity. But for this, we’ll stay focused on the individual banks’ side of the connection, not the different backbones interconnecting them.

A quick history of online financial services

“Online banking” saw humble beginnings in 1981, when several New York City banks began offering their clients the ability to perform banking activities using their phones, or dedicated terminals set up in their homes.

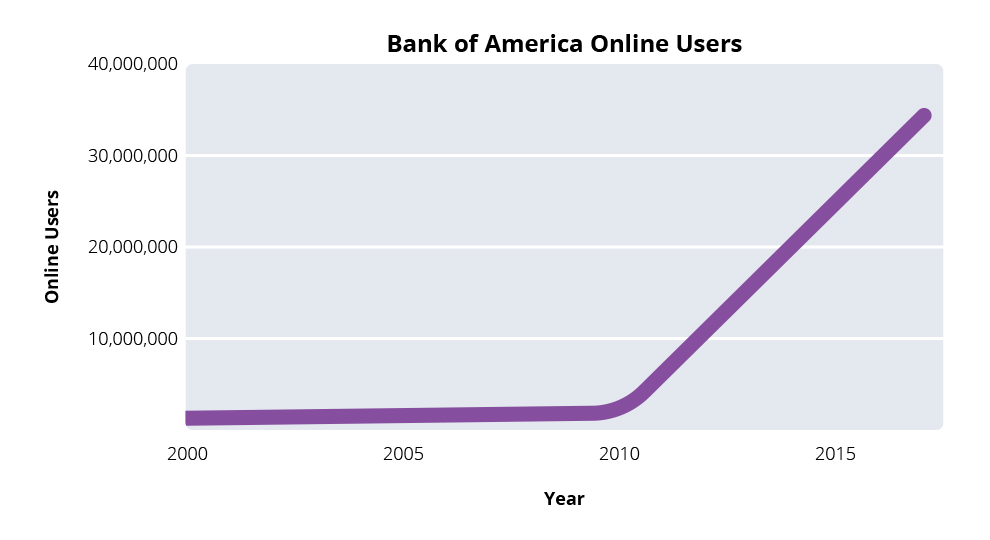

But as the internet reached critical mass in the late 1990s, banks were quick to begin offering web services as well. It also marked the debut of online-only banks around the world. Customer adoption was slow. Despite 80% of banks offering online service by 2000, Bank of America took over 10 years to see 2 million registered users.

That pace didn’t last long. As millennials began opening bank accounts and moving into the work-force, their web-first expectations drove adoption to unheard of levels. In just seven years, Bank of America didn’t just double online users, but grew 17x to 34 million.

Today, nearly every major bank offers some kind of online and mobile banking capabilities. As the majority of the population becomes increasingly connected, more and more banking is done remotely, creating a greater need for stronger bank network connectivity.

The first home banking service was offered to consumers in December 1980 by United American Bank, a community bank with headquarters in Knoxville, Tennessee. United American partnered with Radio Shack to produce a secure custom modem for its TRS-80 computer that allowed bank customers to access their account information securely. Services available in its first years included bill pay, account balance checks, and loan applications, as well as game access, budget and tax calculators and daily newspapers. Thousands of customers paid $25–30 per month for the service. –Wikipedia

Why is connectivity so vital to financial networks?

Bank networks are generally large and complex systems that require a great deal of monitoring across multiple platforms. Financial institutions rely heavily on their networks to perform all of their banking tasks, internal and external. Having a safe, secure, and reliable network is vital to the health of their business, and their customer’s financial wellbeing.

Networks are the backbone of modern businesses, and the cost of downtime is high for the financial sector. VoIP calls, internal systems, and employee productivity all depend on network availability. Simply put, time literally is money.

Why is avoiding banking outages and maintaining network availability so important in the financial sector? There are several reasons, including:

- Trust. Fundamentally, banking is about trust. If your customers don’t view your institution as trustworthy, they won’t use your services. Critical financial systems going down when a customer needs them damages a financial institution’s reputation.

- Regulations & reporting. In many cases, there are regulations and reporting requirements related to financial system uptime and banking outages. For example, under Payment Services Regulations (PSR) 2017 in the UK, financial institutions must report major incidents to the Financial Conduct Authority (FCA) within 4 hours.

- The dollar cost of downtime. Cost of downtime calculations variable depending on business size, systems affected, and industry. However, the cost financial sector tends to consistently land near the top of the list. It’s been estimated that an hour of downtime costs an average of $9.3 million U.S. dollars per hour in the banking/finance industry.

Like any other modern service provider, if a bank can’t keep its operations up and running, customers will shift to other vendors that can. Banking institutions are extremely competitive, and if large-scale or frequent network outages occur, customer trust is lost, and that’s a hard road to come back from.

Preventing banking outages with network monitoring

The financial sector suffers the same common IT issues and as any other industry. However, these challenges are compounded by regulatory requirements, like Sarbanes–Oxley Act of 2002 (SOX), high-expectations from customers, and a hyper-competitive environment where one instance of prolonged downtime can lead to a significant loss of business. Investing in network monitoring seems like a foregone conclusion—especially when it’s the network you rely on for essential business daily, and millions of dollars per hour are at stake.

Modern network monitoring and management solutions have evolved that specifically address a lot of the pain points that IT teams within financial institutions are concerned with, including:

- Real-time network monitoring and alerts. Preventing small issues from becoming emergencies is a key part of moving from reactive troubleshooting to proactive monitoring. Customizable dashboards and alerts keep you on top of every potential metric you’ve identified as your priority.

- Speed root cause analysis. Quality monitoring tools will also automatically keep your network maps and network documentation up-to-date, and help you quickly drill-down to the specific connection or device causing a bottleneck, which can greatly streamline troubleshooting connectivity issues and reduce MTTR (mean time to resolution).

- Capacity planning. Banking networks need to support bursts in traffic without experiencing performance degradation or loss of service. Doing so without wasteful overprovisioning can be a challenge from a design perspective.

- Performance Monitoring. You might like to see great throughput, but what if the data points you can’t see, like CPU warnings or high bandwidth utilization, are about to bring your network crashing down? Financial IT admins need to be able to easily diagnose any issues that may be affecting high utilization rates directly from the dashboard.

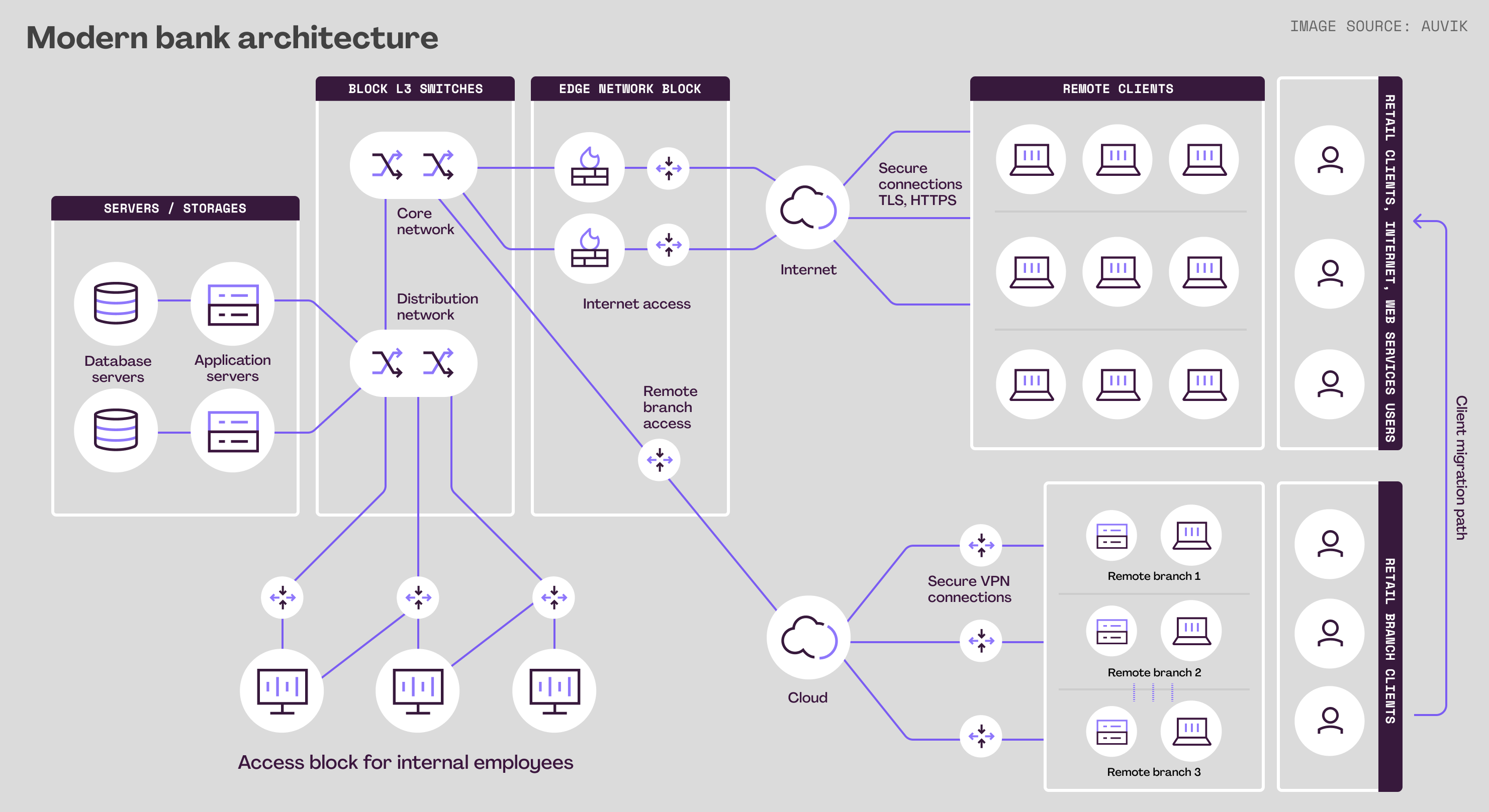

- Vendor/location agnostic. Using a mix of legacy and modern hardware? Cloud-based and on-premise? Top of the line network management software should have the ability, like Auvik, to locate any and all of your connected and virtual devices, in real time, and inventory them with a large database of vendors and models. By providing a map of the entire network, you can easily visualize performance and availability from a bird’s eye view, or zoom in to individual components.

- Distributed site management. Managing multiple branch offices across multiple geographic locations is a different challenge than managing a single datacenter. You need visibility into each site while still maintaining the high levels of security and access control that are table stakes for financial systems’ connectivity.

- Deep traffic monitoring. Get deep visibility into traffic flows across the network to quickly see what area, application, or even individual are doing. Track suspicious activity on a geographic basis. You need that level of visibility and control.

Once a banking network is operational, proactive network monitoring is key to elminating unplanned banking outages, achieving the levels of service banks and other financial institutions require.

Of course, in the financial sector, the bottom line is what really matters. That means businesses must weigh the costs of a given tool against the benefits: streamlining network management while leading to a positive ROI.

That’s why Auvik commissioned industry-leading research firm Forrester Consulting to perform a Total Economic Impact™ study. Forrester found that enterprises that implemented Auvik saw a 173% ROI over the course of three years.

Finding the best network monitor for your network for your environment can be the difference between maintaining high levels of uptime, or being the next banking outage to make headlines. Solutions that provide granular visibility into performance, can monitor distributed sites, make configuration management simple, and are secure enough to meet the demands of the financial sector are key.

Ready to see how Auvik can enhance every aspect of your network management capabilities? Get your free 14-day Auvik trial here.